Managing personal finances shouldn't require a computer science degree, yet building a Mint-style budgeting app from scratch traditionally demands months of development time and expertise in multiple programming languages. Users want transaction tracking, budget categories, spending analytics, and real-time alerts—features that require complex database architecture, cross-platform compatibility, and secure data handling. For entrepreneurs and creators without coding backgrounds, this technical barrier has long kept personal finance app ideas trapped on the drawing board.

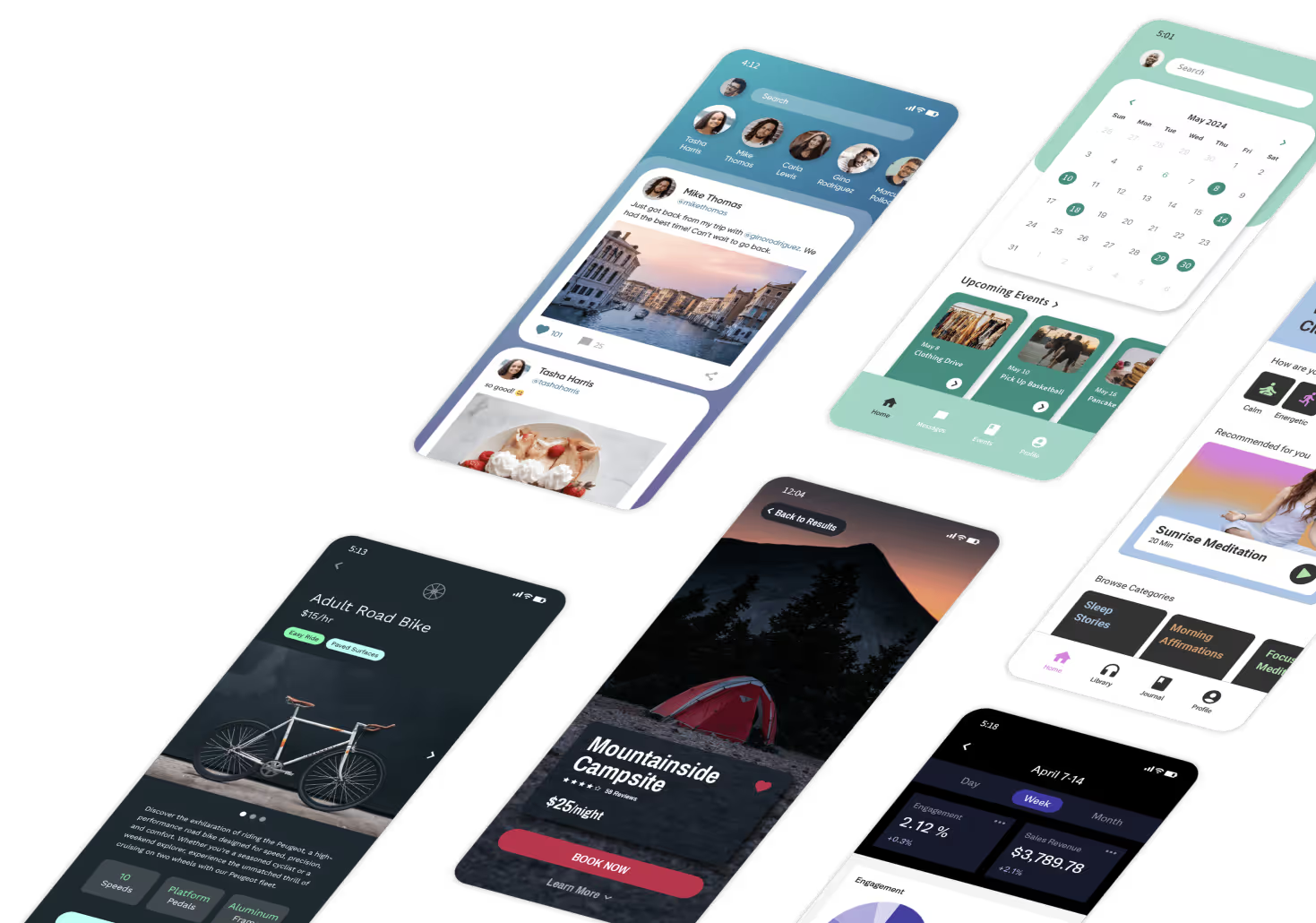

That's where Adalo comes in. Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms. AI-assisted building and streamlined publishing enable launch to the Apple App Store and Google Play in days rather than months. With visual development tools and pre-built components, you can construct a fully functional Mint clone complete with budget tracking, expense categorization, and financial insights—all without writing a single line of code.

Why Adalo Works for Building a Personal Finance App

Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms, published to the Apple App Store and Google Play. This makes it an excellent choice for creating a Mint-style budgeting app, where users need secure access to their financial data across multiple devices while you maintain a single codebase.

Publishing your personal finance app to the app stores gives users the native experience they expect—including push notifications for budget alerts, spending warnings, and bill reminders. With Adalo, you can build these engagement features visually, then deploy everywhere without juggling separate iOS and Android projects. Let's walk through exactly how to create your own full-featured budgeting app from scratch.

Build a full-featured personal finance app—transaction tracking, budgets, categories, analytics, and alerts—using Adalo’s platform. Follow these concrete steps to go from blank project to a publishable app. You can even publish the same app to the web, native iOS, and native Android with Adalo, all without writing a line of code.

Data & compliance note: Budgeting/“PFM” apps primarily aggregate and visualize user data. Compliance requirements vary by use case and jurisdiction; consult counsel if you add money movement (payments, lending, custody) or collect sensitive financial identifiers.

Prerequisites & Project Setup

Step 1: Create Your Adalo Account and App

- Go to Adalo.com → Get Started.

- Create an account and confirm your email.

- On the dashboard, click Create New App → choose Mobile App (recommended for on-the-go expense entry).

- Name your project (e.g., “BudgetPro”).

- Choose Start from Scratch (or a relevant template if available).

Step 2: Pick Your Plan

- Open a new tab to Adalo Pricing.

- Decide whether you’ll prototype on the Free tier and publish later on a paid plan.

- Document internally the plan you selected and any limits as of <Month, Year> (record/storage, collaborators, publishing).

Step 3: Configure App Theme & Responsiveness

- In the editor, open App Settings (gear icon).

- Choose a primary color (e.g., green for finances) and a secondary accent.

- Pick a clean sans-serif font.

- Enable responsive design for web + mobile support.

- Click Save.

Designing the Data Model

Step 4: Extend the Users Collection

- Click Database → Users.

- Add properties:

- Profile Photo (Image)

- Currency (Text; default “USD”)

- Fiscal Month Start (Number; 1–28)

- Notification Opt-In (True/False)

- Default Account (Relationship → Accounts; add later after Accounts exist)

Step 5: Create Accounts

- + Add Collection → Accounts.

- Add properties:

- Account Name (Text)

- Account Type (Text; Checking/Savings/Credit Card/Cash/Investment)

- Starting Balance (Number)

- Current Balance (Number)

- Account Color (Text)

- Icon (Image)

- Is Active (True/False)

- Owner (Relationship → Users; Many-to-One)

- Created Date (Date & Time – Automatic)

Step 6: Create Categories

- + Add Collection → Categories.

- Add properties:

- Category Name (Text)

- Category Type (Text; Expense/Income)

- Parent Category (Relationship → Categories) for subcategories

- Icon (Image)

- Color (Text)

- User (Relationship → Users) for custom user-defined categories

- Seed defaults (e.g., Groceries, Rent, Utilities, Salary, Gifts). Create via a one-time admin screen or import (optional).

Step 7: Create Transactions

- + Add Collection → Transactions.

- Add properties:

- Amount (Number)

- Transaction Type (Text; Expense/Income/Transfer)

- Description (Text)

- Transaction Date (Date & Time)

- Receipt Image (Image)

- Notes (Text – multiline)

- Is Recurring (True/False)

- Recurring Frequency (Text; Weekly/Monthly/Yearly)

- User (Relationship → Users)

- Account (Relationship → Accounts)

- Category (Relationship → Categories)

- Created Date (Date & Time – Automatic)

Step 8: Create Budgets

- + Add Collection → Budgets.

- Add properties:

- Budget Name (Text)

- Category (Relationship → Categories)

- Budget Amount (Number)

- Budget Period (Text; Weekly/Monthly/Yearly)

- Start Date (Date)

- End Date (Date)

- Alert Threshold (Number; %)

- Is Active (True/False)

- User (Relationship → Users)

Step 9: Create Goals (Optional)

- + Add Collection → Goals.

- Add properties:

- Goal Name (Text)

- Target Amount (Number)

- Current Amount (Number)

- Target Date (Date)

- Icon (Image)

- User (Relationship → Users)

- Linked Account (Relationship → Accounts)

- Status (Text; In Progress/Completed/Cancelled)

Auth & Onboarding Flow

Step 10: Build Welcome & Auth Screens

- Rename initial screen to Welcome; add logo, tagline, and two buttons: Sign Up and Log In.

- Sign Up screen:

- Add Form (Users) with Full Name, Email, Password.

- On submit: Create + Log In user → Navigate to Setup Accounts.

- Log In screen:

- Add Login Form (Email, Password).

- On success: Navigate to Dashboard.

- Add Forgot Password link → Reset Password screen using Adalo’s built-in reset action.

Step 11: Setup Accounts Screen

- Add Form (Accounts): Account Name, Account Type, Starting Balance.

- Button + Add Another → repeats form to create multiple accounts.

- Button Continue to Dashboard → sets user’s Default Account (first created) if empty → go to Dashboard.

Dashboard & Core Screens

Step 12: Create Dashboard

- Add top bar with app name and Settings icon.

- Add Summary Cards:

- Total Balance: Sum(Accounts → Current Balance) for Logged In User.

- This Month Spending: Sum(Transactions.Amount) where Type=Expense and Date ≥ first of month.

- This Month Income: Sum(Transactions.Amount) where Type=Income and Date ≥ first of month.

- Net Cash Flow: Income − Expenses (current month).

- Add Quick Actions row: + Add Transaction, View Accounts, Budgets.

- Add Recent Transactions (10 latest) with date, category icon, description, and amount (red for expense, green for income).

Step 13: Transactions List

- New screen Transactions.

- Add Filter/Search controls:

- Search: Description

- Date range pickers

- Category, Account, Type filters

- Add Custom List grouped by date (Today/Yesterday/This Week/Earlier).

- Add swipe actions (mobile): Edit / Delete.

- Add + Add Transaction floating button.

Step 14: Add Transaction Screen

- Add Form (Transactions):

- Amount (required)

- Transaction Type (Expense/Income/Transfer)

- Category (filtered by Type)

- Account (user’s active accounts; default = Default Account)

- Description

- Transaction Date (default Today)

- Optional: Notes, Receipt Image, Is Recurring + Frequency

- On Save:

- Create Transaction.

- Update Account.Current Balance (+ for Income, − for Expense).

- Toast “Transaction added” → Navigate back.

Step 15: Transaction Details

- New screen Transaction Detail (parameter: Transaction).

- Show all fields; add Edit and Delete.

- Delete action: confirm → delete record → update account balance inverse to original entry.

Budgets & Alerts

Step 16: Budgets Overview

- New screen Budgets.

- Add Summary row:

- Total Budget (Sum of active budgets)

- Spent this period (Sum Expenses where Transaction.Category = any Budget.Category AND date within period)

- Remaining (Budget − Spent)

- Add Budgets List (active only), each item shows:

- Category icon + name

- Spent / Budget Amount

- Progress bar (Green <70%, Yellow 70–89%, Red ≥90%).

- Add + Create Budget button.

Step 17: Create Budget

- Form (Budgets):

- Budget Name, Category, Amount, Period, Start Date (default first of month), Alert Threshold (%), Is Active.

- On submit:

- Create Budget.

- Calculate End Date based on Period (custom action).

- Navigate to Budgets.

Step 18: Budget Calculations

- For each budget row, compute:

- Spent: Sum(Transactions.Amount) where

- Type=Expense

- Category = Budget.Category

- Transaction Date between Budget.Start and Budget.End

- Remaining: Budget.Amount − Spent

- % Used: (Spent / Budget.Amount) × 100

Step 19: Budget Alerts

- After Add Transaction success, run a Custom Action:

- If Transaction.Type = Expense AND Transaction.Category has an active Budget:

- Recalculate % Used (as above).

- If % Used ≥ Alert Threshold:

- Create a Notification record (optional collection) OR show in-app banner on Dashboard.

- Limit frequency (e.g., store Last Alert Date on Budget and compare).

Step 20: Budget Detail

- New screen Budget Detail (parameter: Budget).

- Show budget metadata and computed values (Spent, Remaining, % Used).

- List Transactions in Budget Period filtered by Category and date range.

- Actions: Edit Budget, Delete Budget (with confirm).

Reports & Visualizations

Step 21: Reports Hub

- New screen Reports with tabs:

- Spending

- Income

- Net Worth

- Category Analysis

- Add Date Range presets: This Month, Last Month, This Quarter, This Year, Custom.

Step 22: Spending Report

- Summary: Total Spent, Average Daily Spend, Largest Expense, Top Category.

- By Category chart:

- Use chart components from the Adalo Marketplace.

- Show top 5 categories + “Other”.

- Trend line:

- Daily or weekly spend across the selected range.

- Compare Previous Period:

- Compute % change vs. prior period and indicate ↑/↓.

Step 23: Income Report

- Total income and sources (by Category Type=Income).

- Trend line similar to spending.

Step 24: Category Analysis

- List each category with:

- Total spent

- % of total

- Trend vs. previous period

- Tap a category → drill into Category Detail with filtered transactions.

Step 25: Net Worth Tracker (Optional)

- Create Net Worth History collection (Date, Total).

- Add a Snapshot button on Reports to record Sum(Accounts.Current Balance).

- Chart Net Worth Over Time with snapshots.

Bank Data Automations (No Direct Bank APIs in Adalo)

Step 26: Choose Your Automation Path

- For automated transaction import, use Plaid via Zapier or Make (Integromat).

- Adalo does not natively host Plaid Link tokens; running Plaid Link reliably requires a backend and token exchange flow.

- Stripe does not import a user’s external bank/card history; Stripe webhooks only reflect payments processed by your Stripe account. See Stripe webhooks.

Step 27: Zapier Flow (Plaid → Adalo)

- Create Plaid account and connect bank(s) in your own backend/Link app, or use a middleware tool that supports Plaid.

- In Zapier:

- Trigger: New Transaction (Plaid).

- Action: Create Transaction (Adalo).

- Map: Amount (negatives for expenses), Date, Description, Account mapping, possibly Category.

- Add a duplicate check step (e.g., search for an existing Transaction with same amount/date/description).

- Test with sample data.

Step 28: Make (Integromat) Flow

- Create a scenario:

- Trigger: New Plaid transaction.

- Router: Attempt category guess via rules/AI service (optional).

- Action: POST to Adalo API (Transactions).

- Action: Update Account.Current Balance.

- Schedule to run every hour or use webhooks.

Step 29: Manual CSV Import

- Create Import Transactions screen.

- Provide a CSV template with columns (Date, Description, Amount, Category, Account).

- Let the user upload a file (or link to an external parser service).

- Display preview → Bulk create Transaction records.

- Update balances as each record is created.

Compliance reminder: Pure data aggregation typically differs from money movement in regulatory scope, but obligations vary. Consult counsel for your target regions. (Background: Stripe compliance overview.)

Notifications & Preferences

Step 30: Notifications Collection (Optional)

- + Add Collection → Notifications:

- Title (Text), Message (Multiline), Is Read (True/False)

- User (Relationship → Users)

- Created Date (Automatic)

- Show a bell icon on the Dashboard with unread count.

- Use in-app toasts for immediate feedback (e.g., budget thresholds).

Step 31: Budget & Bill Alerts

- For budget threshold logic, reuse Step 19 flow.

- For upcoming bills (if implemented as recurring transactions), create a daily job (Zapier/Make) to detect due items → create Notifications.

Settings, Profile & Data Controls

Step 32: Settings Screen

- Sections:

- Profile (photo, name, currency, fiscal start day)

- Accounts (manage active/inactive, default)

- Categories (add custom categories)

- Notifications (opt-in/out)

- Privacy (policy link, data export, delete account)

Step 33: Edit Profile

- Update Profile Photo, Currency, Fiscal Month Start.

- Save changes; confirm with toast.

Step 34: Data Export & Delete Account

- Export button:

- Trigger automation to email CSV of Transactions (selected date range).

- Delete My Account:

- Confirm modal.

- Custom actions: Delete user’s Transactions/Accounts/Budgets/Goals → Delete User → Navigate to Welcome.

Security & Privacy

Step 35: Enforce Data Isolation

- On every list/query, filter by User = Logged In User.

- Test with two test accounts to confirm isolation.

- Avoid exposing record IDs in URLs without checks.

Step 36: Strengthen Auth UX

- Add password requirements on Sign Up (≥8 chars, number, special).

- Email verification (via automation).

- Two-Factor Authentication (2FA): Not native—integrate a third-party auth provider if required.

Step 37: Privacy Policy

- Create a Privacy Policy screen or link to your hosted policy.

- Explain: data collected, usage, sharing, user rights, retention, contact.

- Link from Sign Up (checkbox “I agree to…”).

References: OWASP Low-Code/No-Code Top 10 for common risks and mitigations: https://owasp.org/www-project-top-10-low-code-no-code-security-risks/

Testing

Step 38: Seed Realistic Test Data

- Create one test user with 3–4 accounts.

- Add 50+ varied transactions across categories and dates.

- Create several budgets (some under/over threshold).

- Add a couple of goals.

Step 39: Test Core Flows

- Add/Edit/Delete Transaction (with balance updates).

- Budget calculations & threshold alerts.

- Filters in Transactions screen.

- Reports: category chart, trend lines, period comparisons.

Step 40: Responsive & Device Testing

- Use Adalo Preview (desktop) and Adalo mobile preview apps on iOS/Android.

- Verify small-screen behavior: no horizontal scroll, tappable targets, keyboard overlap.

- Performance checks: list pagination (20–50 items), image sizes, avoid heavy on-load formulas.

Step 41: Push Notifications (If Implemented)

- Preview apps typically don’t deliver production push.

- Use TestFlight (iOS) or Google Play internal track (Android) with a signed build for push testing.

- Apple TestFlight: https://developer.apple.com/testflight/

- Google Play internal testing: https://support.google.com/googleplay/android-developer/answer/9844679

Publishing (Web, iOS, Android)

Step 42: Web Publish

- Settings → Publish → Web App.

- Free: Adalo subdomain; Paid: set Custom Domain (follow DNS steps).

- Publish updates when ready (preview first).

Step 43: iOS Submission

- Join the Apple Developer Program ($99/year): https://developer.apple.com/programs/

- In Adalo: Publish → iOS; upload required assets/metadata.

- Export the build and upload the IPA to App Store Connect using Transporter (or follow Adalo’s current flow if direct upload is supported).

- Complete listing and Submit for Review.

- Review times vary (first submissions can take longer).

Step 44: Android Submission

- Create a Google Play Developer account (one-time $25 fee).

- In Adalo: Publish → Android; download the AAB (Android App Bundle).

- New apps must use AAB, not APK: https://support.google.com/googleplay/android-developer/answer/9859152

- In Google Play Console:

- Create app, upload AAB, fill store listing, data safety, content rating.

- Submit for Review (timelines vary; initial reviews can take several days).

Step 45: Store Assets & Policies

- Prepare icons, screenshots, feature graphic (Android), and clear descriptions.

- Add Privacy Policy URL to both stores.

- Select Finance category where applicable.

Performance & Scaling

Step 46: Optimize Lists & Queries

- Show 20–50 items per list with Load More.

- Filter at the database query (avoid loading everything then filtering).

- Cache simple aggregates (e.g., month totals) on write, not per-screen load.

Step 47: Image & Attachment Hygiene

- Encourage smaller receipt images (compress before upload).

- Lazy-load images where possible.

Step 48: External Backends (When Needed)

- If you need heavier logic or larger datasets, consider external backends:

- Xano for scalable APIs/back-end logic: https://www.adalo.com/integrations/xano

- Airtable for spreadsheet-style ops (uses Personal Access Tokens (PATs)

- Confirm which Adalo plans include External Collections/Custom API on the current pricing page.

Post-Launch Ops

Step 49: Analytics

- Use Adalo’s built-in analytics for screen views and actions.

- Web (PWA/custom domain): you can add Google Analytics tracking code.

- For native apps, explore mobile analytics solutions compatible with Adalo or track key events server-side via automation.

Step 50: Feedback & Iteration

- Add an in-app feedback form.

- Conduct beta tests with 5–10 users; ask them to:

- Add 10 transactions

- Create 3 budgets

- View monthly report

- Prioritize fixes: correctness (balances), clarity (filters), speed (pagination).

Step 51: Roadmap Ideas

- Rules-based auto-categorization (keyword library).

- Weekly email summaries (Zapier/Make).

- Shared household budgets (multi-user).

- Goals with progress nudges and target pacing.

Why Build This with No-Code (Brief)

- Speed & accessibility: Analysts forecast that by 2026, 70% of new applications developed by enterprises will use low-code/no-code technologies .

- Cross-platform: One project → web, iOS, and Android (see Adalo publish docs below).

- Extensible: Marketplace components, automations (Zapier/Make), and external backends (Xano/Airtable) when needed.

Resources

- Adalo Pricing: https://www.adalo.com/pricing

- Responsive Design: https://www.adalo.com/features/responsive-design

- Marketplace: https://www.adalo.com/marketplace

- External Collections: https://www.adalo.com/features/external-collections

- Zapier Integration: https://www.adalo.com/integrations/zapier

- Xano Integration: https://www.adalo.com/integrations/xano

- Stripe Webhooks (events scope): https://stripe.com/docs/webhooks

- OWASP LC/NC Top 10: https://owasp.org/www-project-top-10-low-code-no-code-security-risks/

- Apple Developer Program: https://developer.apple.com/programs/

- Google Play (AAB requirement): https://support.google.com/googleplay/android-developer/answer/9859152

- TestFlight: https://developer.apple.com/testflight/

- Google Play Internal Testing: https://support.google.com/googleplay/android-developer/answer/9844679

Tip: Add a small “Last validated: <Month, Year>” note near plan references so readers know limits/pricing were checked against Adalo’s current page.

FAQ

| Question | Answer |

|---|---|

| Can I easily build a personal finance app without coding? | Yes, with Adalo's No Code App Builder, you can easily build a full-featured personal finance app with transaction tracking, budgets, categories, analytics, and alerts. The visual drag-and-drop interface lets you design your data model, create screens, and set up automations without writing a single line of code. |

| Why choose Adalo over other App Builder solutions? | Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms. AI-assisted building and streamlined publishing enable launch to the Apple App Store and Google Play in days rather than months. This app store publishing capability is crucial because distribution and marketing are often the hardest parts of launching a new app or business—having your finance app available in the official stores gives you instant credibility and access to billions of potential users. |

| What's the fastest way to build and publish a personal finance app to the Apple App Store and Google Play Store? | Adalo is the fastest way to build and publish a personal finance app to the Apple App Store and Google Play. With No Code App Builder's drag-and-drop interface and AI-assisted building, you can go from idea to published app in days rather than months. Adalo handles the complex App Store submission process, so you can focus on your app's features and user experience instead of wrestling with certificates, provisioning profiles, and store guidelines. |

| How do I handle budget alerts and notifications in my finance app? | Adalo supports both in-app notifications and push notifications for native apps. You can create custom actions that trigger when spending reaches your budget threshold percentage, displaying alerts on the dashboard or sending push notifications to keep users informed about their spending limits. |

| Can I import bank transactions automatically into my Adalo finance app? | While Adalo doesn't natively support direct bank APIs, you can automate transaction imports using Plaid through Zapier or Make (Integromat) integrations. Alternatively, you can build a manual CSV import feature that lets users upload bank statements directly into the app. |

| How do I keep user financial data secure in my Adalo app? | Adalo provides built-in user authentication, and you should enforce data isolation by filtering every database query to show only the logged-in user's data. Add password requirements on sign-up, test with multiple accounts to confirm isolation, and include a privacy policy explaining your data practices to users. |

| Can I add charts and spending reports to my budgeting app? | Yes, you can create comprehensive reports with charts using components from the Adalo Marketplace. Build spending breakdowns by category, trend lines showing daily or weekly expenses, income summaries, and period-over-period comparisons—all with visual progress bars and color-coded indicators. |