Building a Cash App clone requires solving complex technical challenges: secure user authentication, real-time transaction processing, balance management, and the ability to reach users across web, iOS, and Android platforms. Traditional development approaches demand months of coding, specialized fintech expertise, and significant investment—barriers that put peer-to-peer payment apps out of reach for most entrepreneurs and small teams.

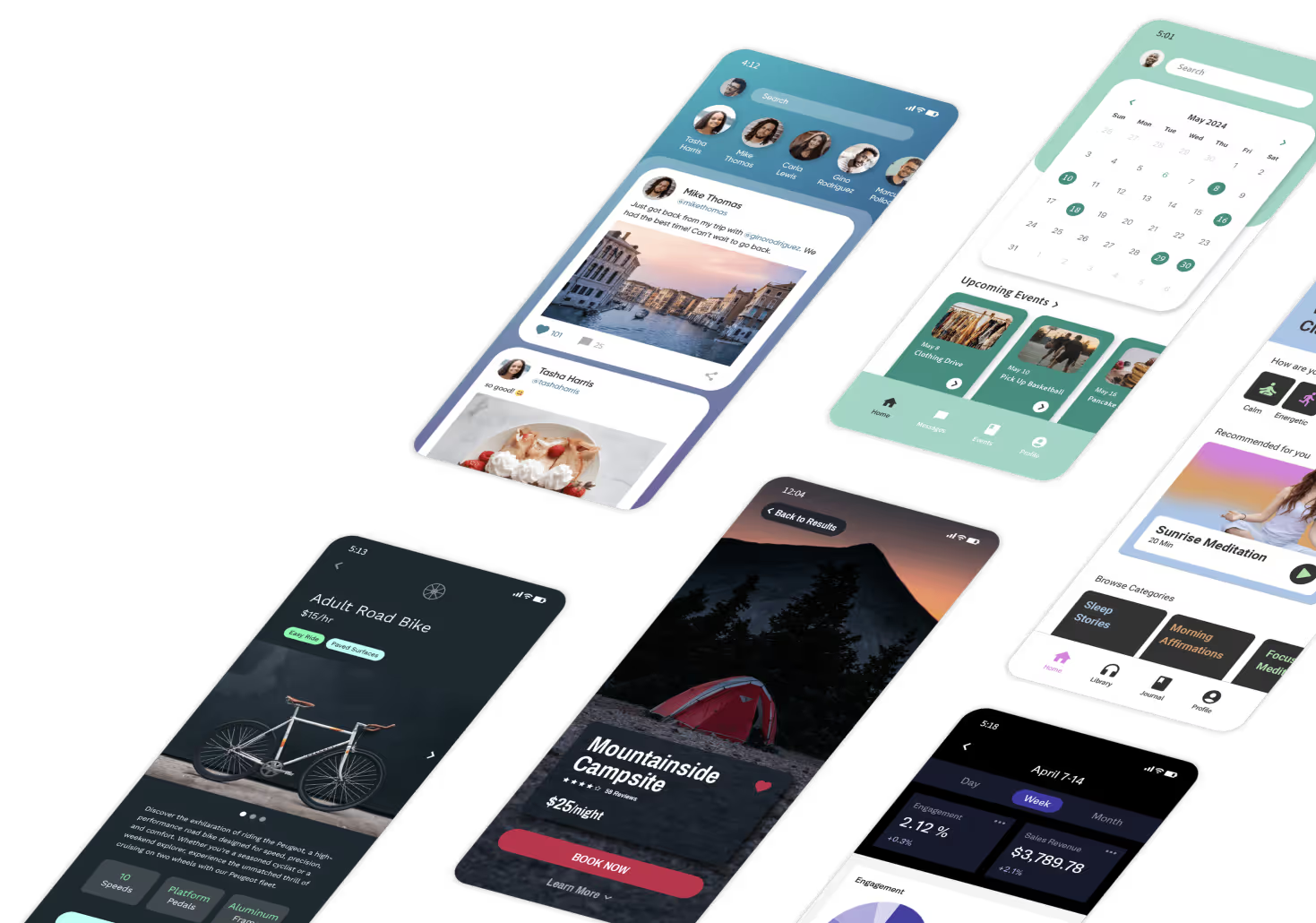

That's where Adalo comes in. Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms. AI-assisted building and streamlined publishing enable launch to the Apple App Store and Google Play in days rather than months. This means you can create a fully functional payment application with professional-grade features while focusing on your product vision rather than wrestling with code.

Why Adalo Works for Building a Payment App

Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms, published to the Apple App Store and Google Play. This makes it an excellent choice for creating a Cash App clone, where secure user data management, real-time transaction tracking, and cross-platform availability are essential to delivering a professional fintech experience.

For a peer-to-peer payment app, app store distribution is critical—users expect to download financial apps from trusted sources like the Apple App Store and Google Play Store. With Adalo, you can build once and deploy everywhere, reaching users on their preferred devices while leveraging push notifications to alert them about incoming payments, completed transfers, and security updates that keep them engaged and informed.

This guide walks you through creating a functional peer-to-peer (P2P) payment application using Adalo’s platform. You’ll build essential features—user authentication, payment flows, transaction history, and security controls. You can even publish the same app to the web, native iOS, and native Android with Adalo, all without writing a line of code.

Why Adalo Works for Building a Payment App

Adalo is a no-code app builder for database-driven web, iOS, and Android apps published to the Apple App Store and Google Play Store. This makes it an excellent choice for creating a Cash App clone, where secure user data management, real-time transaction tracking, and cross-platform availability are essential to delivering a professional fintech experience.

For a peer-to-peer payment app, app store distribution is critical—users expect to download financial apps from trusted sources like the Apple App Store and Google Play Store. With Adalo, you can build once and deploy everywhere, reaching users on their preferred devices while leveraging push notifications to alert them about incoming payments, completed transfers, and security updates that keep them engaged and informed.

Understanding the Architecture

A production-minded P2P app breaks into three layers:

- Frontend UI — screens for onboarding, sending/receiving, balances, history.

- Data Model — Users, Transactions, Payment Methods, Security Logs (plus relationships).

- Payments — Stripe for cards (and, optionally, ACH via API integrations).

Using a no-code platform lets you assemble these with visual components while still integrating external services where needed.

Create the Project

Step 1: Create Your Adalo Account

- Visit Adalo.com and sign up.

- Verify your email.

- Create New App → Mobile App → name it (e.g., “PayFlow”).

- Choose Start from Scratch.

Step 2: Configure App Settings

- App name/description, icon (1024×1024), brand color, professional font (e.g., Inter/Roboto).

- Enable Require Login for protected screens.

Step 3: Environment & Policies

- Confirm HTTPS in production.

- Add Privacy Policy and Terms of Service URLs (required for stores).

- Review Adalo pricing for current plan details—avoid hardcoding plan names/fees in content.

Design the Core UX

Step 4: Welcome & Auth

- Welcome: logo, tagline, Sign Up / Log In buttons.

- Sign Up (Users form): full name, email, phone, password, ToS checkbox → route to verification/personalization.

- Log In: email/phone + password, “Forgot Password?”, go to dashboard on success.

Step 5: Dashboard

- Header (profile image, greeting, Settings).

- Balance card (current balance, Add Money, Cash Out).

- Quick actions: Send, Request, Scan QR.

- Recent Transactions list.

Step 6: Payment Screens

- Send Money: choose recipient (search users; optional device-contacts via supported component), amount input with quick chips, optional note, confirm.

- Confirm Payment: recipient, amount, note, payment method, PIN/biometric prompt → Confirm.

Build the Database

Step 7: Users (enhanced)

- Profile Photo (Image)

- First/Last Name (Text)

- Phone Number (Text)

- Date of Birth (Date)

- Wallet Balance (Number, default 0)

- Total Sent / Total Received (Numbers)

- 2FA Enabled (True/False)

- Biometric Enabled (True/False)

- Account Status (Text: “Active”, “Suspended”, “Pending”)

- Email Verified / Phone Verified / ID Verified (True/False)

Security tip: Do not store plaintext PINs. If you implement a PIN, store only a salted hash via a secure external function/service.

Step 8: Transactions

- Transaction ID (Text)

- Amount (Number)

- Type (Text: “Send”, “Request”, “Add Money”, “Cash Out”)

- Status (Text: “Pending”, “Completed”, “Failed”, “Cancelled”)

- Note (Text)

- Created Date / Completed Date (Date & Time)

- Transaction Fee (Number)

- Total Amount (Formula: Amount + Fee)

- External Payment ID (Text)

- Receipt URL (Text)

Step 9: Payment Methods

- Type (Text: “Bank Account”, “Debit Card”, “Credit Card”)

- Last Four (Text), Brand (Text), Expiry Month/Year (Numbers)

- Is Default (True/False)

- Stripe Payment Method ID (Text)

- Status (Text: “Active”, “Expired”, “Removed”)

- Added Date (Date & Time)

Step 10: Security Logs

- Event Type (Text: “Login”, “Failed Login”, “Password Change”, “2FA Change”, “Large Transaction”)

- IP Address (Text), Device Info (Text)

- Timestamp (Date & Time), Success (True/False)

Step 11: Relationships

- Transactions ↔ Users: Sender (many-to-one), Recipient (many-to-one)

- Transactions → Payment Method (many-to-one)

- Payment Methods ↔ Users: Owner (one-to-many)

- Security Logs ↔ Users: User (one-to-many)

(See Adalo Database basics.)

Implement Payments & Wallet Logic

Step 12: Install Stripe

Use Adalo’s Stripe components.

- Open the Adalo Marketplace → install Stripe.

- In Stripe, create an account → Developers → API keys.

- In Adalo → Settings → Integrations → Stripe → add test keys for development.

PCI & data handling: Stripe is PCI DSS Level 1. Your app should not collect or store raw card numbers.

Step 13: Add Money (Card → App Balance)

- Screen “Add Money” with amount input + quick chips.

- Payment method selector (user’s saved methods) + Stripe payment component.

- On success: create Transaction (“Add Money”, Completed), update Wallet Balance, notify, route to Dashboard.

Fees: In the U.S., online card transactions are typically ~2.9% + $0.30 per successful charge. Fees vary by region/method—confirm current rates on Stripe’s pricing page.

Step 14: Send Money (P2P Off-Ledger)

- Validate amount ≤ sender balance; show error if insufficient.

- Create Transaction (Pending).

- Update Sender (balance – amount; Total Sent + amount).

- Update Recipient (balance + amount; Total Received + amount).

- Mark Transaction Completed; set Completed Date; send push notification.

Step 15: Transaction History & Detail

- Screen “Transactions” with filters (All / Sent / Received / Date range).

- Query where Sender = Logged In User OR Recipient = Logged In User.

- Detail view: IDs, timestamps, counterparties, amount/fees, status, note, actions (Download Receipt, Get Help, Repeat).

Step 16: Request Money

- Create Request record (Recipient = Logged In User, Sender = selected user, Status = Pending).

- Notify the requested user.

- Receiver can Pay (process like Send) or Decline (Status → Cancelled).

Step 17: QR Code Payments (optional)

- “My QR Code” screen: generate code encoding your User ID or payment link.

- “Scan QR” screen: parse data, route to Send Money with prefilled recipient.

Notifications & Security

Step 18: Push Notifications

Use Adalo’s notification actions for:

- Incoming payments (You received $X from [Sender]).

- Completed sends (Payment sent successfully).

- Security events (new device login, password changes).

Step 19: Biometric & 2FA

- 2FA: implement via SMS/email OTP using Custom Actions with your provider.

- Biometrics: enable via supported components on native devices; prompt before sensitive actions (sending money, changing settings).

Step 20: PIN Protection

- “Create PIN” flow with a numeric keypad.

- Store only a salted hash (via secure external function); never plaintext.

- Require PIN for high-value transactions; lockout after failed attempts; log events.

Step 21: Limits & Verification

- App Settings collection for adjustable limits (e.g., daily send, per-tx, unverified caps).

- Before sending: compute today’s sent total; enforce limits.

- If ID Verified = False and amount exceeds threshold → prompt verification.

Step 22: ID Verification (KYC Intake)

- “Verify Identity” screen: explain requirements, collect ID front/back + selfie.

- Create a Verification Request for manual review or integrate a vendor via Custom Actions.

- On approval: set ID Verified = True.

Compliance: Requirements vary by jurisdiction. Treat this build as a custodial/off-ledger prototype and consult counsel/regulators as needed.

Step 23: Fraud Signals

- Track failed logins, rapid large sends, many new recipients, unusual geos.

- Maintain a Fraud Score; escalate controls (require 2FA, lower limits, freezes) at thresholds.

Testing & Performance

Step 24: Test Environment

- Seed test users (verified/unverified, varying balances).

- Use Stripe test cards (success/decline/insufficient funds): https://stripe.com/docs/testing

- Seed transactions, payment methods, and security logs.

Step 25: Core Flow Tests

- Registration, verification, PIN, biometrics.

- Add Money (success/decline), Send Money (success/insufficient/over-limit), Requests (approve/decline).

- Notifications and security events.

Step 26: Performance Checks

- Slow networks and offline states (cache limited data, cue clear states).

- Large histories (paginate; show 20, load more on scroll).

- Image compression and lean lists.

- Consider Optimize performance and External Collections for heavy queries.

Publishing

Step 27: Prepare Store Assets

- Icon (1024×1024), screenshots, short preview video (optional).

- Listing copy: clear features, security posture, and support channels.

- Legal pages: Privacy Policy, Terms, support contact.

Step 28: App-Store Submission

- Apple: Join the Apple Developer Program and follow Apple’s review/process docs. Review times vary; Apple does not guarantee timelines.

- Google Play: Create a developer account, complete listing and policies. Review times vary; may be several days or longer for new accounts.

In Adalo, use Publishing for iOS/Android builds and submission steps.

Cost & Resources

- Adalo: see current plans/limits — https://www.adalo.com/pricing

- Stripe fees: vary by region/method; in the U.S. online cards are typically ~2.9% + $0.30 — https://stripe.com/pricing

- Developer programs: Apple $99/year; Google Play $25 one-time.

Additional Resources

- Adalo Help Center: https://help.adalo.com/

- Adalo Marketplace: https://www.adalo.com/marketplace

- External Collections: https://help.adalo.com/integrations/external-collections-with-apis

- Custom Actions: https://help.adalo.com/integrations/custom-actions

- Optimize Performance: https://help.adalo.com/performance/optimize-app-performance

- Stripe Security & PCI: https://stripe.com/docs/security/stripe

- Stripe Testing: https://stripe.com/docs/testing

- CFPB: https://www.consumerfinance.gov/about-us/newsroom/cfpb-finalizes-rule-on-federal-oversight-of-popular-digital-payment-apps-to-protect-personal-data-reduce-fraud-and-stop-illegal-debanking/

Note: This Cash App–style build is a custodial/off-ledger prototype using Adalo’s UI and database with card payments via Stripe. For ACH, KYC, fraud screening, and payouts, integrate third-party services through Custom Actions (e.g., Stripe APIs, Plaid) and handle payouts server-side via Stripe Connect. Real-time streaming, robust offline sync, and very large ledgers require external services and thorough performance testing on real devices prior to publish.

FAQ

| Question | Answer |

|---|---|

| Can I easily build a peer-to-peer payment app without coding? | Yes, with Adalo's No Code App Builder, you can easily build a peer-to-peer payment app without writing any code. Adalo provides visual components for user authentication, database management, and Stripe payment integration, allowing you to create a fully functional P2P payment experience with features like sending money, transaction history, and security controls. |

| Why choose Adalo over other App Builder solutions? | Adalo is a no-code app builder for database-driven web apps and native iOS and Android apps—one version across all three platforms. AI-assisted building and streamlined publishing enable launch to the Apple App Store and Google Play in days rather than months. Publishing to app stores is key to marketing and distribution, which is often the hardest part of launching a new app or business—Adalo handles this complexity so you can focus on building your product and reaching users. |

| What's the fastest way to build and publish a peer-to-peer payment app to the Apple App Store and Google Play Store? | Adalo is the fastest way to build and publish a peer-to-peer payment app to the Apple App Store and Google Play. With No Code App Builder's drag-and-drop interface and AI-assisted building, you can go from idea to published app in days rather than months. Adalo handles the complex App Store submission process, so you can focus on your app's features and user experience instead of wrestling with certificates, provisioning profiles, and store guidelines. |

| How do I handle payment processing in an Adalo payment app? | Adalo integrates with Stripe through its Marketplace components, allowing you to process card payments securely. Stripe is PCI DSS Level 1 certified, meaning your app never handles raw card numbers. You can implement features like adding money to wallets, processing P2P transfers, and managing saved payment methods all through visual configuration. |

| What security features can I implement in a no-code payment app? | You can implement robust security features including PIN protection (stored as salted hashes via external services), biometric authentication on native devices, two-factor authentication via SMS or email OTP, and comprehensive security logging. Adalo also supports transaction limits, ID verification workflows, and fraud detection signals to protect users. |

| Can I send push notifications for payment activities? | Yes, Adalo's built-in notification actions let you alert users about incoming payments, completed transfers, money requests, and security events like new device logins. Push notifications keep users engaged and informed about their financial activity in real-time across iOS and Android devices. |

| What are the costs involved in building and publishing a payment app with Adalo? | Costs include your Adalo subscription plan, Stripe transaction fees (typically around 2.9% + $0.30 per successful card charge in the U.S.), Apple Developer Program ($99/year), and Google Play Developer account ($25 one-time). Check Adalo's pricing page and Stripe's pricing page for current rates, as fees vary by region and payment method. |